Welcome to Disney Park Nerds

Simple, travel hacking tips for your next Disney vacation – anywhere in the world

Disneyland

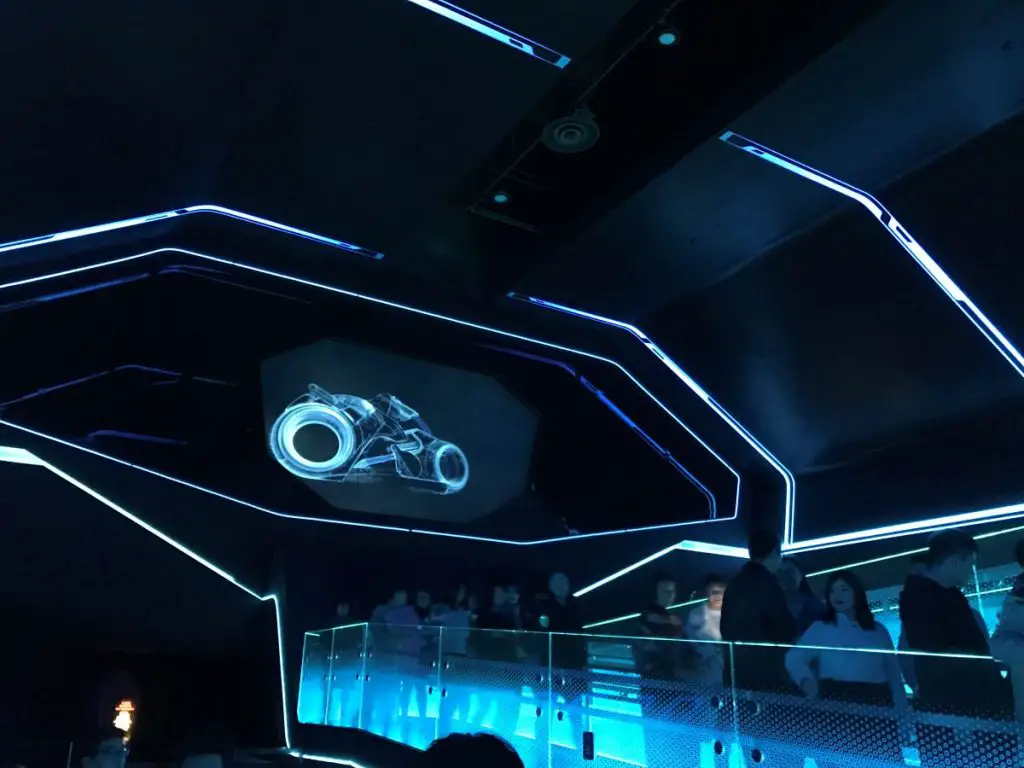

Disney World

Disney World Tickets

Disney World Hotels

Animal Kingdom

EPCOT

Disney Springs

Magic Kingdom

Hollywood Studios